People frequently fall for investment tricks, thinking that the only way to earn big returns is to do the latest trendy thing. Unless you have access to a sitting politician’s financial advisor to benefit from insider trading, you’re not likely to do much better than the average market return. Chasing trends is almost guaranteed to do worse. (And insider trading gets you in jail unless you’re politically connected.)

Basic Personal Finance Chapter 9 talks about real estate as an investment. Spoiler: It’s not very good. The long-term real rate of return of home ownership is negative 0.5%. You can probably do better with rental properties, but that’s a pretty high-risk, high-stress investment.

In Chapter 7, we warned against high-risk investments like futures, options, and commodities without really getting into the details. One of the biggest commodities being pushed since 2021 is gold. Actually, it’s always been pushed as a hedge against inflation, but a lot of people didn’t take it seriously until inflation really kicked up in 2021.

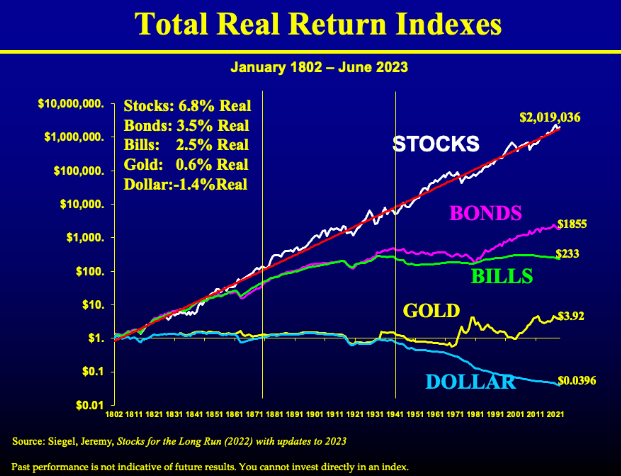

Ben Carlson, recently had a post on his site, A Wealth of Common Sense, that included a chart based on Jeremy Sigel’s book, Stocks for the Long Run.

That puts gold into perspective as an investment vehicle. The total real return for gold was 0.6% compared to stocks at 6.8%. Why the difference? Gold doesn’t produce anything, whereas stocks are ownership in companies that take resources (like gold) and create value by producing things worth more than those resources. In the language of Section 7.1 (Investing vs. Saving) of Basic Personal Finance: Gold is a resource for preservation of capital, not for capital growth.

Just think about the companies encouraging you to purchase gold to save you from the collapse of the dollar: they’re willing to take your soon-to-be-worthless dollars and give you their all-important gold. If it’s so important, why are they selling it? This was highlighted perfectly by Zach Weinersmith in his SMBC comic (image used by permission).

Currently the inflation-adjusted price of gold is near record high: $2,039.15. There are only three other peaks that exceed that amount:

- Feb 1980, afterwhich gold lost nearly 60% of its value in the next 18 months

- Aug 2011, afterwhich gold lost 45% of its value by Nov 2015

- Aug 2020, afterwhich gold dropped 26% by Sep 2022

If gold isn’t your thing, you may be tempted to chase other trendy things like cryptocurrency or some hot new stock. The problem there is that once you hear a lot of hype about a particular investment, it most likely is no longer a great investment. Recall the efficient market hypothesis: new information is incorporated nearly instantly so you can’t consistently do better than the average market return. Once the hype starts, the price of the new “super investment” is already inflated to reflect that hype. Even day traders know the motto: “buy low, sell high.” Once there’s hype, you’re buying high. Of course, it could go higher. That’s why the people who initially bought the new “super investment” talk it up to encourage more investors. That makes their investment better.

Basic Personal Finance makes the case that “disciplined saving and patient, long-term investing are the simplest, most consistent ways to accumulate wealth.” Start early because “time in the market is more important than timing the market.” You should be making monthly contributions (dollar-cost averaging) to a no-load, open-end, broad market index fund and grow your nest egg to at least $500K before you start to think about doing anything fancy or hiring a financial planner/advisor.