A recent post by Rutgers University’s Center for Real Estate claims owning a rental home is a good investment. From the post: “A comparison of Sharpe ratios suggests the risk-adjusted rate of return to housing in New Jersey might be high relative to both stocks and bonds.” If you read deeper, you realize the author used a little sleight of hand to come to that conclusion.

The study was limited to New Jersey, which itself is misleading for anyone thinking of rental property because NJ is one of the most expensive areas of the country to live (based on the percentage of income people spend on housing). However, the study only used 371 of the 739 ZIP codes because of incomplete data. The study period was 1987-2014 and the investment return was measured by the sum of the income produced (i.e., rental income) and the change in real asset value. These gains were compared to stocks (dividends + capital gains) and bonds (interest payments).

The author reports annual returns that seem reasonable: 9.7 percent for stocks, 6.8 percent for rental real estate, and 4.3 percent for bonds. The claim that rental real estate is a better investment is based on the Sharpe Ratio, a measure of risk-adjusted return calculated by:

(Average_return – Risk_free_rate) ¸ Standard_deviation_of_returns

The Sharpe Ratios were 0.45 for stocks, 0.59 for bonds, and 0.80 for rental property.

Even though the author isn’t trying to sell you rental property, you should always look into someone’s claims. Look at the fine print, and you’ll quickly see a couple issues with this study. First, the rental yields were based on Zillow’s “price-rent” ratio, but that data was only available since 2011. The author estimated the rental yield by assuming it followed the yield on 5-year treasury bonds. Next, the author assumed a 5% “allowance for depreciation, maintenance and property tax.” If you’re going to claim rental property is a better investment based on risk-adjusted measures, you can’t assume away the variability of the asset’s returns! A steady 5% cost is unrealistic from a risk perspective because housing repairs and maintenance are unpredictable and can be very expensive (i.e., thousands of dollars for any one major repair: HVAC, roofing, plumbing, etc.). At least the author admitted “this assumption matters.”

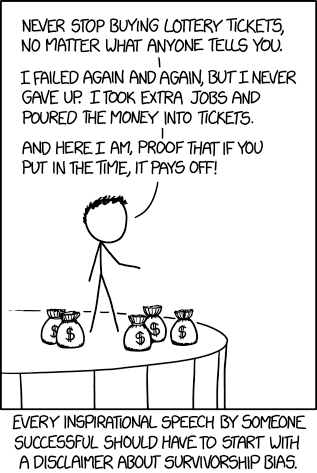

Always be suspicious of anyone claiming some particular investment is the best! Do your homework and check the numbers for yourself as best you can before committing to anything.